Saving for school?

Say hello to Hadley,

your 529 Plan app.

Link your 529 so anyone can send money to it – and that's it. Niece-inspired, uncle-made. Hadley helps all families save.

New to 529s? Get the plan that’s right for you, for free.

You’re going to love our app.

Find My 529 Plan Match

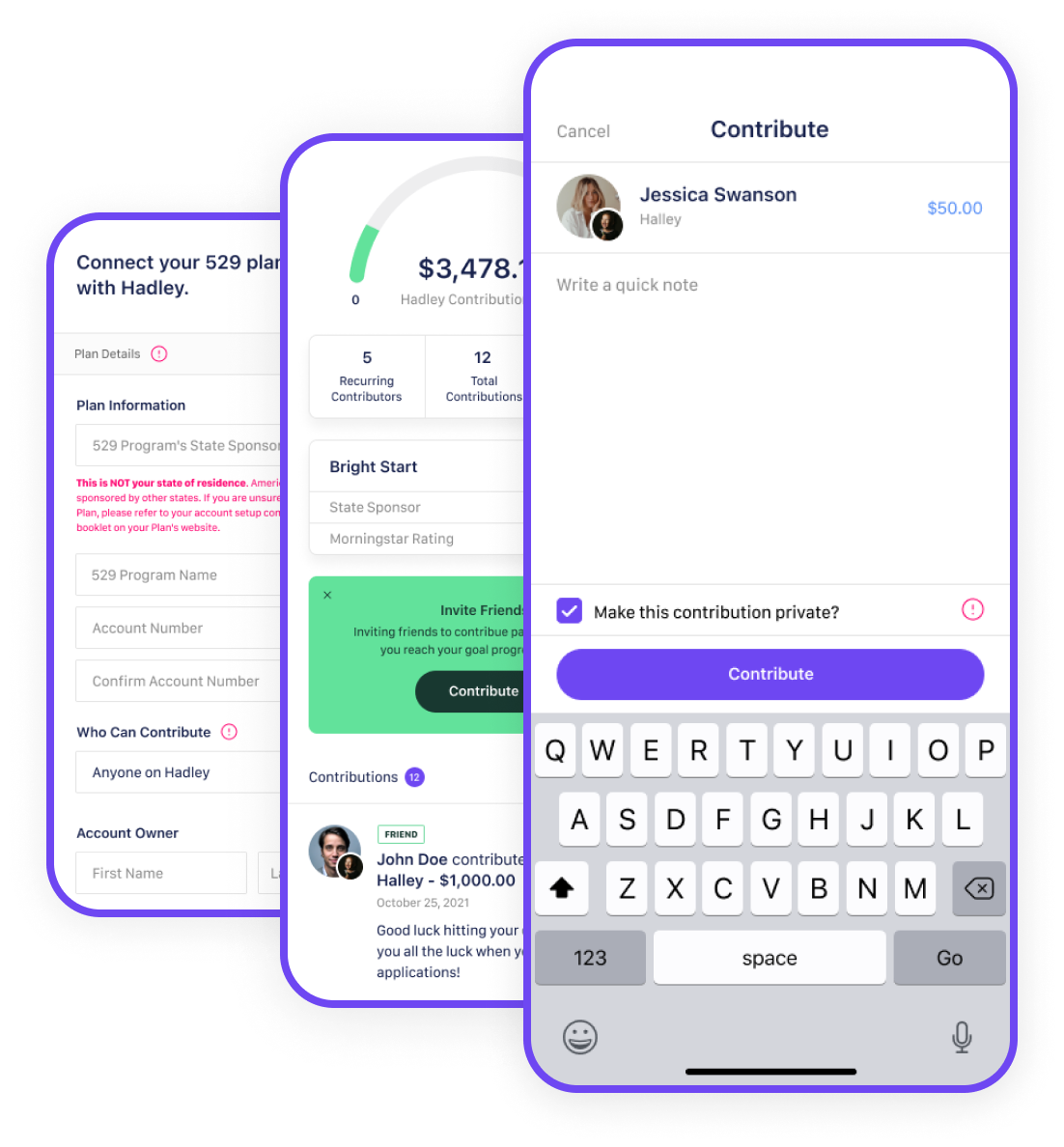

Hadley, as easy as 1-2-3

- Download the app & select your plan

- Hadley works with all 529 plans

- Our website matches you, for free. Signup takes 5 minutes

-

Hadley gives you the same advice Hadley’s uncle gives his own family.

Read our story

- Goodbye regifting, hello education savings.

- Did we mention 529s cover study abroad, too – Barcelona, anyone?

Yes, we really did just make it that easy.

529s cover a wide range of school costs at all stages

529s cover a wide range of school costs at all stages, including private K-12, college, and grad school – and also off-campus housing, books, art supplies, and computers, to name just a few. Check out our FAQs to learn more.

Tax breaks for everyone saving for education

Money in a 529 grows tax-free, and Congress gives this big tax break to all families, regardless of income.

What’s more: 529 funds can rollover into Roth IRAs, up to $35k per beneficiary. Parents can also take advantage by opening 529s today for themselves; there are no age or income restrictions for 529 accounts.

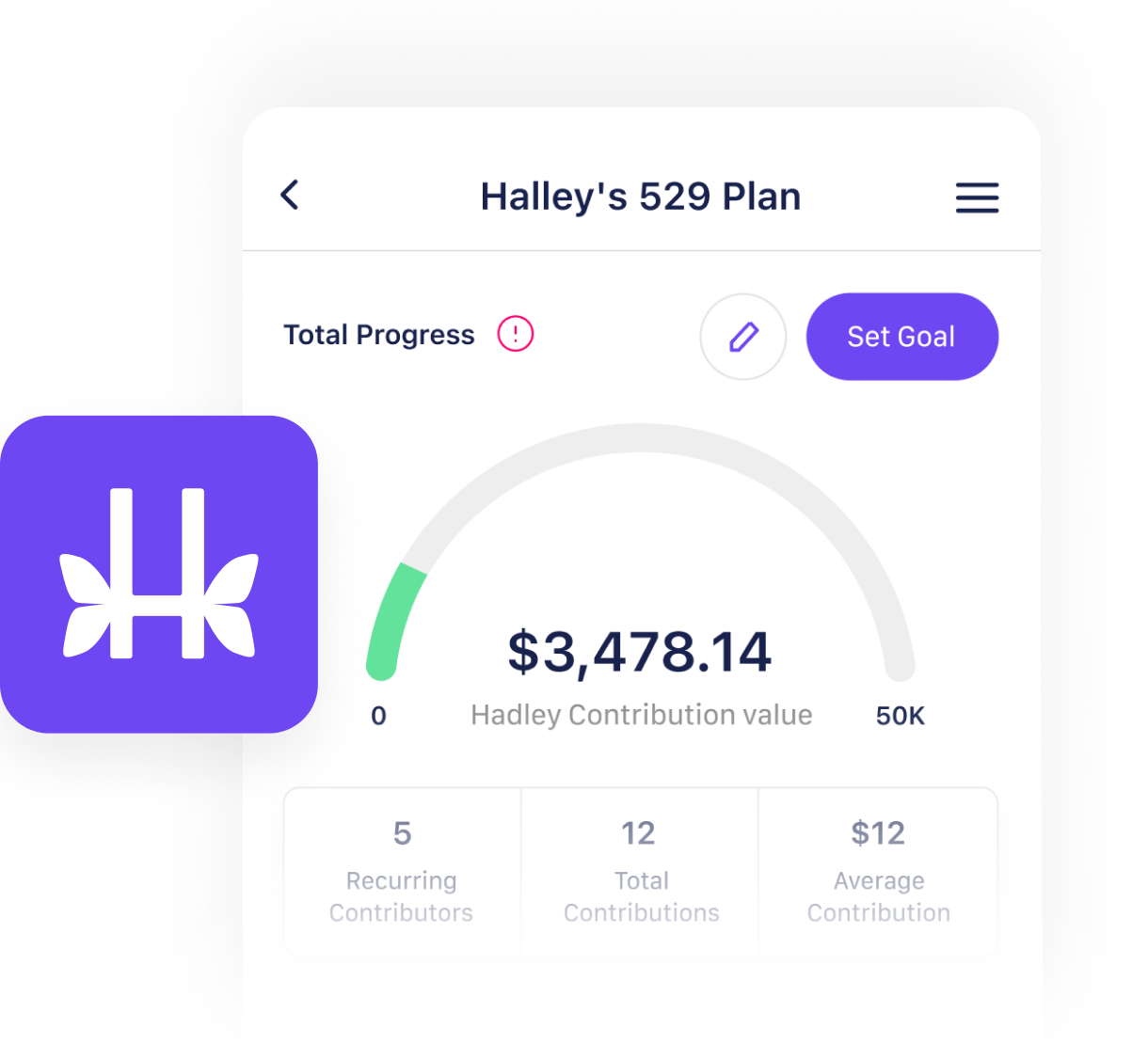

The info and convenience you need, at your fingertips

Most people still don’t know about 529s, and those who do are mostly in poor-rated plans with high fees. Hadley exists to fix this.

We humanized saving for school. We guide you to what’s in your best interests, not your advisor’s.

529 savings are flexible for everyone in the family

529s can also cover trade schools, apprenticeships, and other postsecondary programs.

If things change, transfer funds to any family member – including future kids. Great Scott!

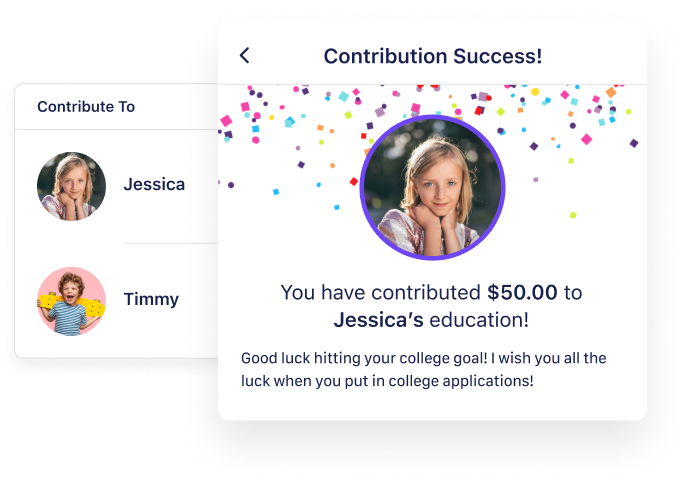

Gifting: The sky’s the limit when we help each other save for it.

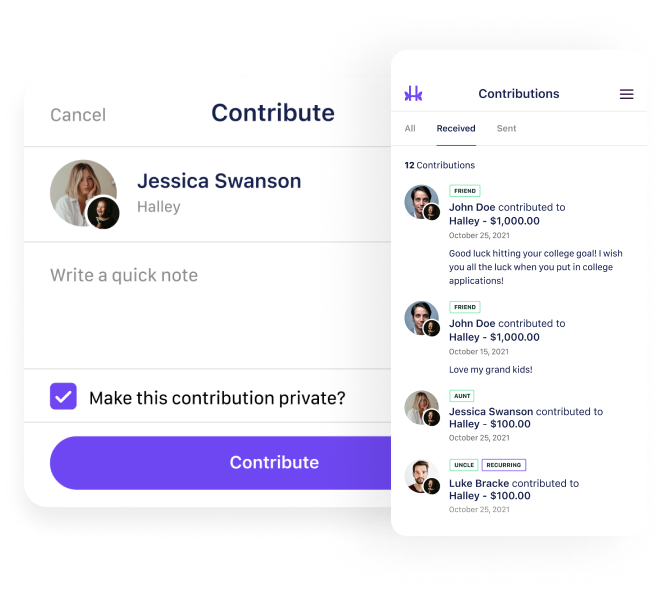

Say hello to your new favorite app. Every family saving in a 529 can use Hadley. No more awkward gift conversations dancing around school costs. And no more endorsing or mailing checks, complicated website logins, or invite codes.

Even easier! Set recurring contributions so you never miss a birthday. Or make weekly contributions. Or both.

We’re a public benefit corp committed to helping others save for our best futures.

After figuring out how to best save for his nieces, Hadley founder Yosh Miller made it his mission to give all families the same kind of advice he gives his own family when it comes to saving for school.

A 529 savings plan, which gets its name from the tax code, is the go-to option for savings education because of tax breaks it offers.

Today, Americans overwhelmingly miss the mark when it comes to saving for school.

Join the movement. Spread the word.

Get Started

We're here to help families save for their best futures!

Unaware of 529 Plans

7 out of 10 Americans are completely unaware of 529 plans.

Saving in Regular Accounts

Today, 1 in 2 families are saving for education in a regular bank savings or checking account.

Saving in Retirement Accounts

Nearly 1 in 4 families are saving for education using a retirement account like a 401k.

Hadley is a mission-oriented, public benefit company and registered investment advisor with the SEC. We make it easier to save for education–at every stage of life–for everyone. Form CRS

Why Use Hadley

Good question. Hadley is packed with potential benefits you won’t find anywhere else.

View All Frequently Asked QuestionsHadley factors in your savings goals, where you live, and your preferred saving style to find the top-rated 529 plan that’s right for you. Once you enroll in a 529 plan, Hadley helps boost your savings.

- No sign-up fee

- No advisory fees

- No monthly or annual user fees

- Connect with friends and family so they can make gifts directly within the app

With its big tax advantages, a 529 plan is a super effective way to save for education. You pay absolutely no taxes on 529 investment gains AND no taxes upon withdrawal, as long as the money is used for qualifying education expenses. Some 529 savers receive additional tax breaks from their state, too, for saving in a 529 Plan.

Unlike investment advisors (who profit off your saving!), with Hadley there are no advisory, sign-up or subscription fees and plan recommendations are completely free. You only pay a nominal processing fee that ranges from $1.49 for contributions under $150 to a $20 cap for contributions over $2,000.

529 Programs charge their own fees when you enroll in one of their plans. Information about their fees is contained in the Program’s Disclosure Booklet. Fees vary with each program, and most 529 account holders today are overpaying in poorly-rated plans. Hadley routes users to top-rated 529 Plans so less money is taken out in fees and more money can be retained in your education savings account.

You can link as many 529 plans to your account as you’d like. But we mean it when we say it: we find the Plan that’s most advantageous for you. When it comes to saving for education, Hadley removes the guesswork and the pain of administration. Your savings and gifts from friends and family are in a top-rated, low-fee plan.